Welcome to the 15th edition of the Yearn Finance Newsletter. Our aim with this newsletter is to keep the Yearn and the wider crypto community informed of latest news, including product launches, governance changes, and ecosystem updates. If you’re interested in learning more about Yearn Finance, follow our official Twitter and Medium accounts.

Summary

Curve Admin Fee Distribution

Initial UI Implementations of COVER & C.R.E.A.M

Yearn Quarterly Financial Report

Launch of the YETI Token

Yearn State of The Vaults

Partnership Roundup

Governance Roundup

Ecosystem News

Curve Admin Fee Distribution

Curve.fi has begun distributing a portion of trading fees on its platform to users who have vote-locked their CRV tokens. Approximately, $3m in 3Crv, the LP token for the 3pool, can be claimed. Yearn has a yveCRV “Backscratcher” vault that vote-locks CRV in order to boost the returns of several Yearn vaults. Depositors of this vault are also eligible to receive the 3Crv rewards noted above.

If you have deposited CRV to our yveCRV vault you can claim your rewards here.

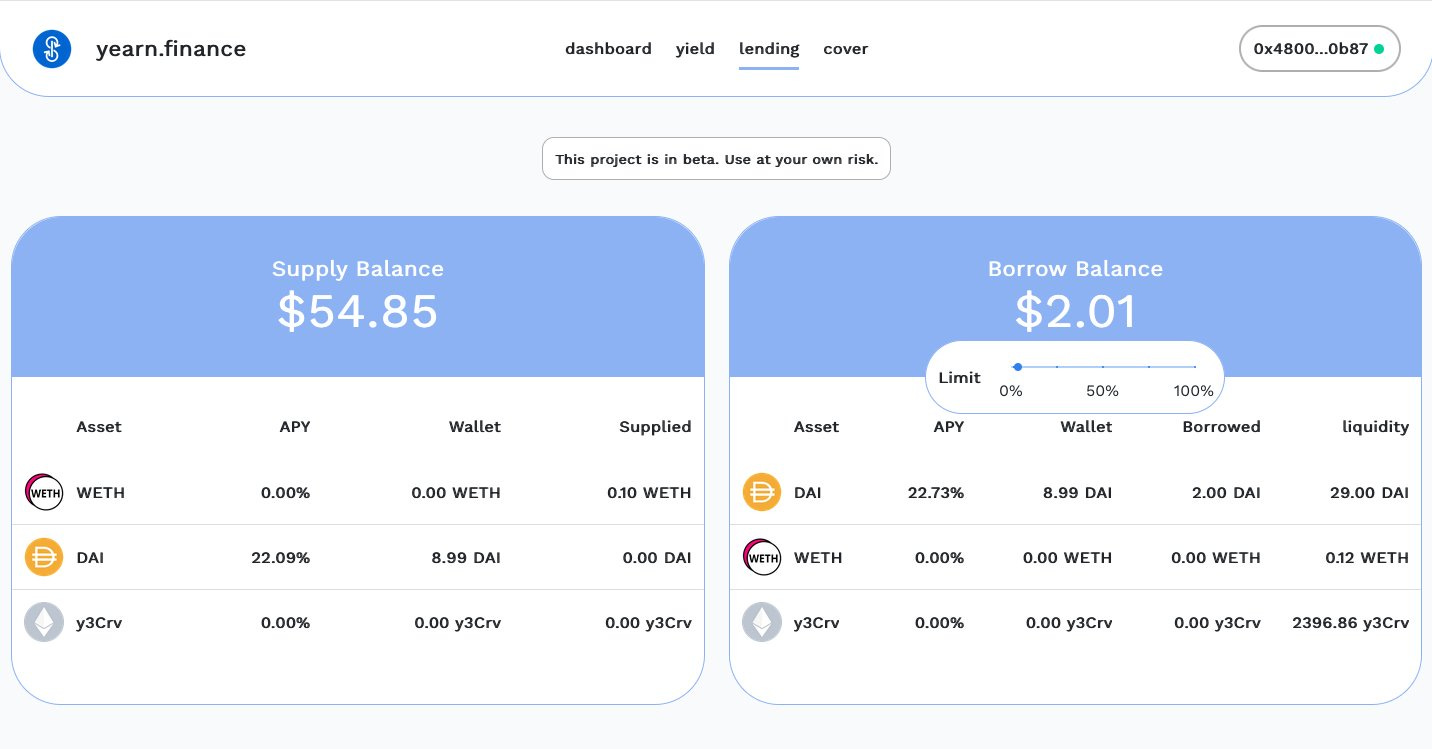

Initial UI Implementations of COVER & C.R.E.A.M

COVER & C.R.E.A.M have recently joined the Yearn ecosystem as partners. We have been updating our user interface in order to allow Yearn users easy access to these products. You can read more about our partnerships with COVER & C.R.E.A.M here and here, respectively.

The new UI that features both COVER & C.R.E.A.M products can be accessed here. Please understand that both integrations are under testing and still undergoing improvements.

Yearn Finance Quarterly Report

Several Yearn community members have created an informal quarterly financial report covering the period from August 2020 to October 2020. This report was generated using publicly available information, and includes an income statement and balance sheet. This report has not been audited by a third-party professional accounting firm, and does not represent financial, investment, or advice of any kind. It is for informational purposes only.

You can view this report here.

Launch of the YETI Token

PowerPool is creating a set of indexes consisting of several tokens in the decentralized finance (DeFi) space. Their first index, PIPT, consists of AAVE, YFI, SNX, CVP, COMP, wNXM, MKR, & UNI. They have created a second index that consists of tokens within the Yearn ecosystem. This index is called the YETI (Yearn Ecosystem Token Index) and consists of YFI, CREAM, COVER, CVP, SUSHI, AKRO, KP3R, & PICKLE.

You can purchase YETI using several supported ERC20 tokens, and PowerPool will automatically swap your token into a split consisting of the eight tokens noted above. You can also stake YETI in one of three pools (some require ETH) to earn CVP, the governance token of the PowerPool ecosystem.

You can purchase YETI here.

Yearn State of the Vaults

You can read our weekly synopsis regarding Yearn’s yVaults, including current strategies and upcoming changes here.

Partnership Roundup

You can read our weekly partnership roundup discussing updates involving partners in the Yearn ecosystem here.

Governance Roundup

You can read our weekly governance roundup discussing newly proposed, on-going, or passed governance proposals here.

Ecosystem News

Several v2 yVaults deployed recently

Yearn v2 yVaults technical diagram

v2 yVaults code review status on GitHub

USDC & DAI yVaults will permit approve & deposit in a single transaction

An overview of the new HEGIC strategy

Yearn yVaults contributors guide published on GitHub

First single transaction vault deposit completed

More updates to the Feel the Yearn app

First USDC harvest for v2 yVault USDC COMP strategy

Thread about the recent Yearn partnerships and it’s ecosystem

Спасибо вам очень хорошо