Welcome to the 24th edition of the Yearn Finance Newsletter. Our aim with this newsletter is to keep the Yearn and the wider crypto community informed of latest news, including product launches, governance changes, and ecosystem updates. If you’re interested in learning more about Yearn Finance, follow our official Twitter and Medium accounts.

Summary

YIP-59: Temporarily Extend Multi-sig Empowerment Has Passed

v2 yETH Vault Has Launched

Yearn Exceeds $1b in TVL

v2 yDAI Deposit Limit Increased

State of the Vaults

Partnership Roundup

Ecosystem News

YIP-59: Temporarily Extend Multi-sig Empowerment Has Passed

A new Yearn Improvement Proposal (YIP) was voted on our Snapshot last week to temporarily extend the multi-sig empowerment for an additional 3 months, through May 31st, 2021. This vote passed with 100% of the eligible vote in favor on February 23rd, and is now effective. A long-term plan to transition to a more formal DAO structure is anticipated to be developed according to the YIP.

You can read the full description of the YIP and view the results of the vote here.

v2 yETH Vault Has Launched

We are pleased to announce that our v2 yETH vault has formally launched and is now listed on our website. Our v2 yVaults are more advanced than our v1 yVaults as they are able to bifurcate deposits into multiple strategies simultaneously. Our Strategists will cycle through the most optimal strategies automatically for depositors. Additionally, our v2 yVaults incorporate our 2%/20% fee structure, which is a 2% management fee assessed on total assets, and a 20% performance fee. Withdrawal fees are removed for depositors.

There is currently a deposit limit of 25,000 ETH for this vault. You can view and access this yVault here.

Yearn Exceeds $1b in TVL

It is with great pleasure to announce that Yearn has recently surpassed $1b in total-value-locked (TVL), across several of our products. A few platforms reporting TVL in decentralized finance (DeFi) have been incorrectly reporting our TVL metrics; however, we are in discussion with them to update and correct their figures.

As of February 28th, this is a breakdown of assets deposited into Yearn products

$290,649,253 iearn

$423,031,835 v1 vaults

$223,579,696 v2 vaults

$153,226,062 Iron Bank

--

$1,090,486,845 Gross TVL

$82,217,260 duplicate

$1,008,269,586 Final TVL

More information in this tweet.

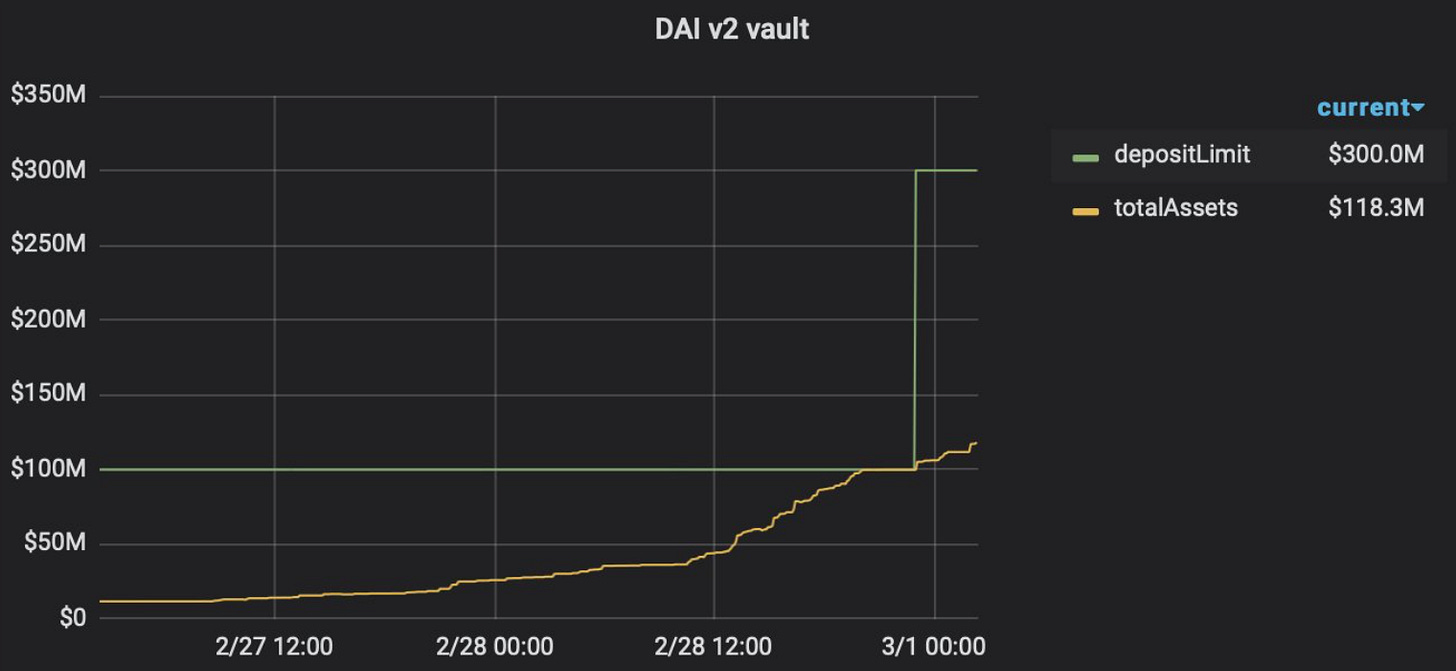

v2 yDAI Deposit Limit Increased

The deposit limit for our v2 yDAI vault has been increased from $100m to $300m. This vault is currently generating a 21.2% APY for depositors. As mentioned above, our v2 yVaults are more advanced than v1 yVaults as they are able to employ multiple strategies per vault. Additionally, v2 yVaults have a 2%/20% fee structure described above.

You can view and deposit into this yVault here.

State of the Vaults

You can read our weekly synopsis regarding Yearn’s yVaults, including current strategies and upcoming changes here.

Partnership Roundup

You can read our most recent bi-weekly partnership roundup discussing updates involving partners in the Yearn ecosystem here.

Ecosystem News

Yearn v2 yVaults integrated into DeFi Earn on crypto.com

Deposit into our St. ETH yVault and earn CRV, LDO, and trading fees

Our DUSD yVault is earning depositors a high APY

Credit Default Swaps by COVER, a Yearn ecosystem partner.