Welcome to the 26th edition of the Yearn Finance Newsletter. Our aim with this newsletter is to keep the Yearn and the wider crypto community informed of latest news, including product launches, governance changes, and ecosystem updates. If you’re interested in learning more about Yearn Finance, follow our official Twitter and Medium accounts.

Summary

Introducing Coordinape

Launch of Several New yVaults

New Zap for the yveCRV-ETH Pickle Farm

Yearn.Vision: A New Monitoring Dashboard

State of the Vaults

Partner Roundup

Ecosystem News

Introducing Coordinape

We are introducing Coordinape: a scalable and permissionless platform to decentralize operations at Yearn and help compensate contributors more effectively. Coordinape will be used to distribute community grants in a decentralized manner. Any individual who has ever received a recurring or community grant will receive an allocation of 100 GIVE tokens. These tokens can be allocated to contributors in the Yearn community to split half of the monthly community grant budget. Salaried Yearn contributors are only eligible to allocate GIVE tokens since they already receive monthly compensation.

Coordinape is in the alpha phase and changes are likely to be made to the platform as a result of feedback from the community, or from other improvements identified. The amount of grants allocated to the Coordinape program for this month is $20,000. We aim to make this the model for all decentralized autonomous organizations (DAOs) in the wider DeFi community.

You can access Coordinape and allocate your GIVE tokens here.

Launch of Several New yVaults

We are pleased to announce the launch of several new yVaults: v2 YFI, 1INCH, and a new v1 LINK yVault. Our v2 yVaults are more advanced as they are able to employ multiple strategies per yVault, while our v1 vaults can only manage one strategy per vault. This enables the vault to cycle between more profitable opportunities as they emerge in the market with no actions required of end-users. This is all controlled automatically by the Strategist of the vault.

Our new v1 LINK yVault is earning CRV rewards by providing liquidity in the LINK/sLINK pool on Curve.Finance. Users that wish to earn a return on their LINK or sLINK with a strategy that has no Impermanent Loss should deposit into the Curve LINK/sLINK pool here. Then deposit the crvLINK liquidity pool token into our crvLINK yVault here. Depositors of our yVaults focused on Curve strategies are able to benefit from boosted CRV rewards as a result of our yveCRV “Backscratcher” vault.

You can access all of our yVaults here.

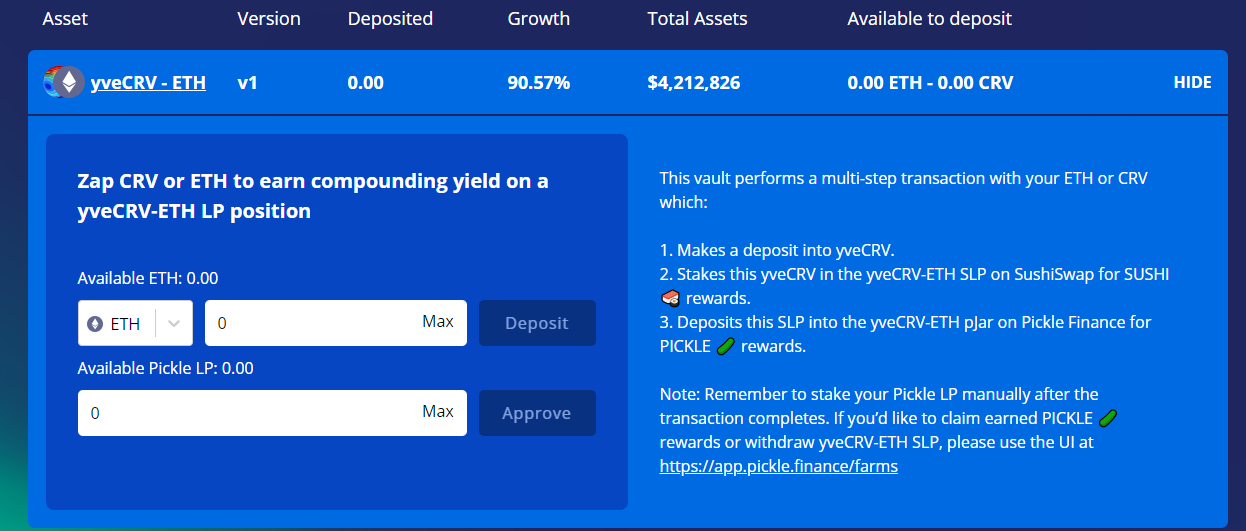

New Zap for the yveCRV-ETH Pickle Farm

This week we have launched a new 1-click zap into the yveCRV-ETH Farm on Pickle Finance (a Yearn ecosystem partner). You can now deposit either CRV or ETH on our user interface and we will automatically zap them into the Farm on Pickle Finance.

Users lock their CRV into yveCRV in exchange for a share of the Curve Finance DAO fees (2 basis points on every trade). The CRV locked in this vault also boosts CRV rewards on all vaults that employ Curve strategies. We also created a pool on SushiSwap, yveCRV-ETH, in order for depositors to obtain their initial principal back, if desired. This pool earns SUSHI rewards as an incentive. Pickle Finance has created a Jar that automatically harvests and compounds these rewards. Additionally, users can earn additional PICKLE rewards by depositing to the Jar liquidity provider token into the Farm on Pickle Finance. As a result, users will earn SUSHI, PICKLE, Sushi trading fees. APY is currently 90.53%.

You can Zap into the yveCRV-ETH Farm here.

Yearn.Vision: A New Monitoring Dashboard

In order to increase transparency and correct errors in calculating the total-value-locked (TVL) within the Yearn ecosystem, we are introducing Yearn.Vision. This dashboard displays the TVL between Vaults (v1 & v2), Iron Bank, Experimental Vaults, v1 iEarn. You can now monitor growth of TVL between these respective products. Take a look at Yearn.Vision using this link.

State of the Vaults

You can read our weekly synopsis regarding Yearn’s yVaults, including current strategies and upcoming changes here.

Partnership Roundup

You can read our weekly partnership roundup discussing updates involving partners in the Yearn ecosystem here.

Ecosystem News

Yearn Treasury has obtained 2,000 KP3R to fund yVault harvesting

New features constantly being added to Yearn’s website

1-click migration from v1 to v2 yYFI

Modeling language to describe yVault strategies

Thread on our our new LINK yVault works

Making new strategies is becoming easier for Yearn developers

Yearn developer team quickly withdrew funds from Big Data Protocol after issue identified