Summary

1-Click Zap into Yearn Vaults Now Live

Yearn Total Value Locked is Exploding

YLA/USDC Pool Live on SushiSwap

New Strategy for the YFI Vault

State of the Vaults

Partner Roundup

Ecosystem News

1-Click Zap Into Yearn Vaults Now Live

Easily zapping into Yearn yVaults has historically been one of our most widely requested features. Zap allows a user to deposit into a yVault even if he does not have one of the underlying tokens. For example, if a user has ETH and wants to enter the USDC yVault he would have to swap his ETH for USDC first before entering, however, by zapping in he can deposit ETH and enter the USDC vault simultaneously. This technology is enabled by Zapper Finance that automatically swaps the ETH into USDC and then the vault with no additional actions required of the user. By incorporating zaps we have simplified the number of steps needed to enter yVaults, and better align with our mission to make DeFi simple.

You can read our original announcement introducing zaps here. The deposit button on each of our yVaults now has a drop-down that will enable a user to zap into the vault. You can find our vaults here.

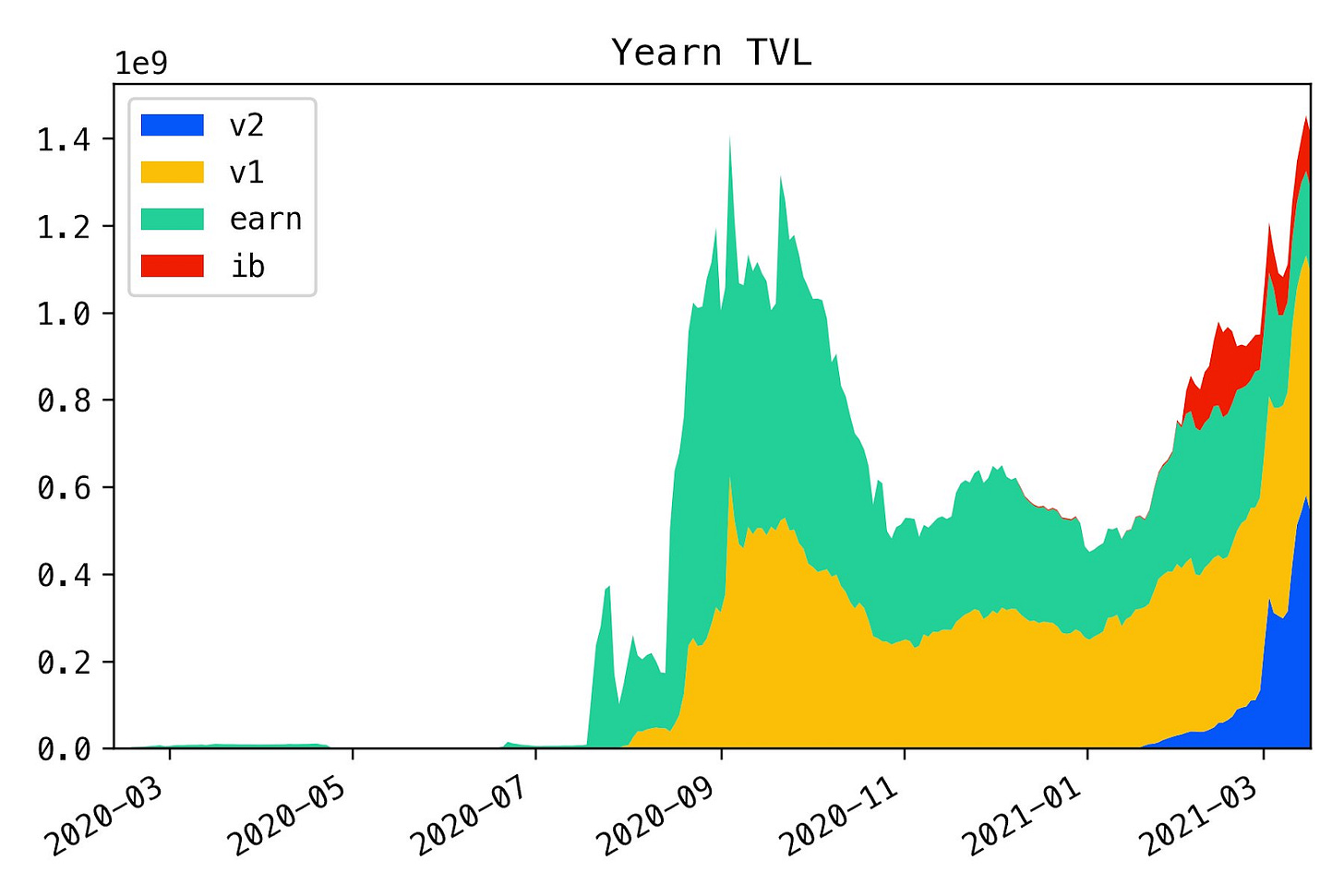

Yearn Total Value Locked is Exploding

Total value locked between Yearn products has experienced explosive growth, and we have now surpassed our previous TVL peak reached in September 2020. The rapid growth in TVL is largely attributed to the release of our v2 vaults in January 2021, more v1 vaults, launch of our Iron Bank.

We anticipate TVL to continue its upward trend as we are hard at work crafting and developing more yVaults that will add value to our end-users and make DeFi simple. Further, we have recently released a new dashboard, which you can find here, that is a graphical representation of total value locked between our major products.

Upwards and Onwards! 🚀🚀

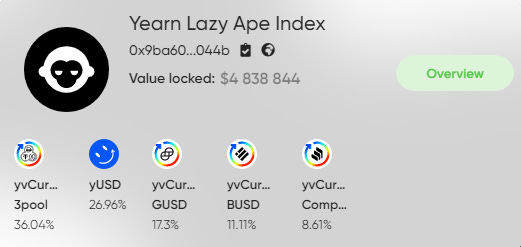

YLA/USDC Pool Live on SushiSwap

Last week we announced the launch of the Yearn Lazy Ape (YLA) index created by PowerIndex. This index consists of five v1 Yearn yVault liquidity provider tokens. The vaults include, yUSD, yvCurve-Compound, yvCurve-GUSD, yvCurve-BUSD, and yvCurve-3pool. The aim of the YLA is to create a diversified cash-flow generating basket of some of the most popular v1 yVaults.

The YLA/USDC pool on Sushiswap was created to increase liquidity into the YLA and to decrease gas costs by up to 68x relating to entering or exiting the index. This pool is now live on Sushiswap earning SUSHI rewards. As of the date of publication, the YLA/USDC is earning 15.82% in SUSHI rewards in addition to the approximately 30% APY earned from the underlying yVaults. PowerIndex has also introduced a 1-click ZAP that enables easy and cost-effective zaps into the YLA using USDC.

Deposit into the YLA here, and into the YLA/USDC on SushiSwap here.

New Strategy for the YFI Vault

We are proud to announce a new strategy for our YFI yVault. The strategy deposits YFI into MakerDao, mints DAI, and deposits DAI into our yDAI vault. The yDAI vault is currently utilizing two different strategies. The first is earning COMP on Compound Finance and uses flashloans to obtain additional leverage. Earned COMP is sold for more DAI, while the second strategy looks for the best lending rates for DAI among a variety of money markets. Ultimately, the YFI vault represents a buy-and-hold strategy, continuously earning you more YFI in the process.

You can enter the YFI vault here.

State of the Vaults

You can read our weekly synopsis regarding Yearn’s yVaults, including current strategies and upcoming changes here.

Partner Roundup

You can read our weekly partnership roundup discussing updates involving partners in the Yearn ecosystem here.

Ecosystem News

Insightful article by Gemini covering Yearn Finance

Our UI now more accurately indicates the APY a user can expect to earn

crvUST vault is live and earning 31.43%