Welcome to the 30th edition of the Yearn Finance Newsletter. Our aim with this newsletter is to keep the Yearn and the wider crypto community informed of latest news, including product launches, governance changes, and ecosystem updates. If you’re interested in learning more about Yearn Finance, follow our official Twitter and Medium accounts.

Summary

Yearn Has Purchased An Additional 29.97 YFI For $1.1m

Total Value Locked Has Surpass $3b

Discussion On Our Forum Regarding Governance 2.0

Badger WBTC Vault Powered By Yearn

sBTC yVault Migration

Three v2 yVaults Coming To C.R.E.A.M

Yearn Has Purchased An Additional 29.97 YFI For $1.1m

We are pleased to announce that Yearn Treasury has purchased 29.97 YFI for $1.164m at an average price of $41,621. This is in accordance with YIP-56: Buyback and Build Yearn that was passed in January 2021. This purchase also demonstrates confidence in the long-term value of the YFI token as Yearn Treasury is comfortable purchasing additional tokens at over $41k.

Yearn Treasury will periodically purchase additional YFI in the future using profits earned by the protocol until a new governance proposal is passed that alters this buyback policy. You can read about the BABY proposal here.

For more information, a detailed breakdown of previous YFI purchases by Yearn Treasury can be found here.

Total Value Locked Has Surpassed $3b

Yearn total value locked (TVL) is continuing to experience parabolic growth and we have now surpassed $3b in TVL across all Yearn products. We anticipate growth to continue and we are comfortable that our products provide among the best risk-adjusted returns in DeFi, while also making it extremely simple for depositors. Let Yearn do the hard work for you and continuously compound your funds.

You can view TVL metrics using this link.

Discussion On Our Forum Regarding Governance 2.0

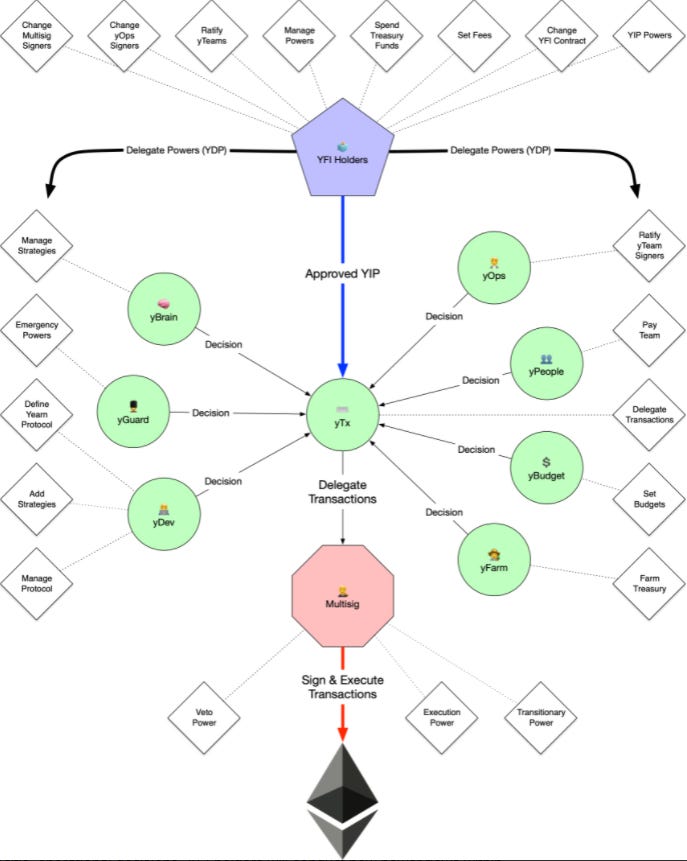

A new discussion is on our governance forum to further clarify Yearn’s operational governance structure by extending certain authority held by the Multisig and establishing newly empowered autonomous contributor groups, known as “yTeams”. Several new teams would be established to govern specific areas of Yearn’s operations. These teams would include, yGuard, yBrain, yDev, yPeople, yBudget, yFarm, yTx, yOps among other teams that would potentially be created in the future.

This potential YIP aims to create a more long-term lasting DAO governance structure as the YIP-41 Temporarily Empower the Multisig is set to expire in May 2021.

You can read the full details and vote on the governance poll of this multifaceted proposal here. Please note that this poll is non-binding and merely gauges sentiment before a formal YIP is created and voted on Snapshot.

Badger WBTC Vault Powered By Yearn

Badger DAO has recently partnered with Yearn to help power their WBTC vault. Badger will be using underlying Yearn technology to earn yield for depositors, while also giving them additional BADGER and DIGG rewards on top. Currently only whitelisted addresses (2,117) can deposit, each with a 0.5 BTC limit, and a total 50 BTC cap for the vault.

We look forward to launching more vaults with Badger and furthering our professional relationship that will add more value for end users in DeFi. You can access the Yearn powered WBTC vault by Badger here.

sBTC yVault Migration

We are migrating our sBTC yVault from v1 to v2 vaults. V2 vaults are more advanced and will earn depositors higher yield. We are also introducing a 1-click migration to make the transition easy for depositors currently in the v1 vault. Withdrawal fees related to this migration are temporarily waived, but only for a limited time. We encourage you to do the migration as soon as possible as fees related to the migration may be assessed at a later date.

You can migrate the vault here.

Three v2 yVaults Coming To C.R.E.A.M

Yearn ecosystem partner C.R.E.A.M will be adding three v2 yVaults to it’s lending platform. These yVaults include yvCurve-sETH, yvCurve-stETH, and yvCurve-IronBank, and we are excited to give depositors of these vaults the opportunity to earn additional yield on the C.R.E.A.M lending platform. Stay tuned for additional updates.

State of the Vaults

You can read our most recent synopsis regarding Yearn’s yVaults, including current strategies and upcoming changes here.