Yearn Finance Newsletter #36

Welcome to the 36th edition of the Yearn Finance Newsletter. Our aim with this newsletter is to keep the Yearn and the wider crypto community informed of the latest news, including product launches, governance changes, and ecosystem updates. If you’re interested in learning more about Yearn Finance, follow our official Twitter and Medium accounts.

Summary

Yearn Partners Have Earned $564K

SEBA Bank Publishes A Report On Yearn

Two Hundred Yearn v2 Strategies Deployed

C.R.E.A.M Finance Lists Two yVault Tokens

MakerDAO’s Lower Stability Fees Benefit Yearn Strategies

Vaults At Yearn

Yearn Partners Have Earned $564K

If you build on top of Yearn, you can earn up to 50% of the fees Yearn generates. Current partners including Alchemix, Inverse Finance, BadgerDAO, and Frax have earned $564K in the most recent partner distribution. Our partner program has increased the revenue of Alchemix by 52%

Partners who have benefitted from Yearn include Inverse Finance, which gained a reliable yield infrastructure for their DCA vaults and DOLA stabilizer, and BadgerDAO, which has received 8% of the ySett vault’s revenue. Details about being a partner can be found in this tweet.

Apply to be a partner here.

A calculator to determine partner sharing revenue can be used here.

SEBA Bank Publishes A Report on Yearn

SEBA Bank AG, a Swiss cryptocurrency company bridging the gap between traditional finance and DeFi, has published a comprehensive report on Yearn. This report covers Yearn’s competitive advantage, governance proposals, an investment thesis, and discloses their own valuation of Yearn.

Read the report here.

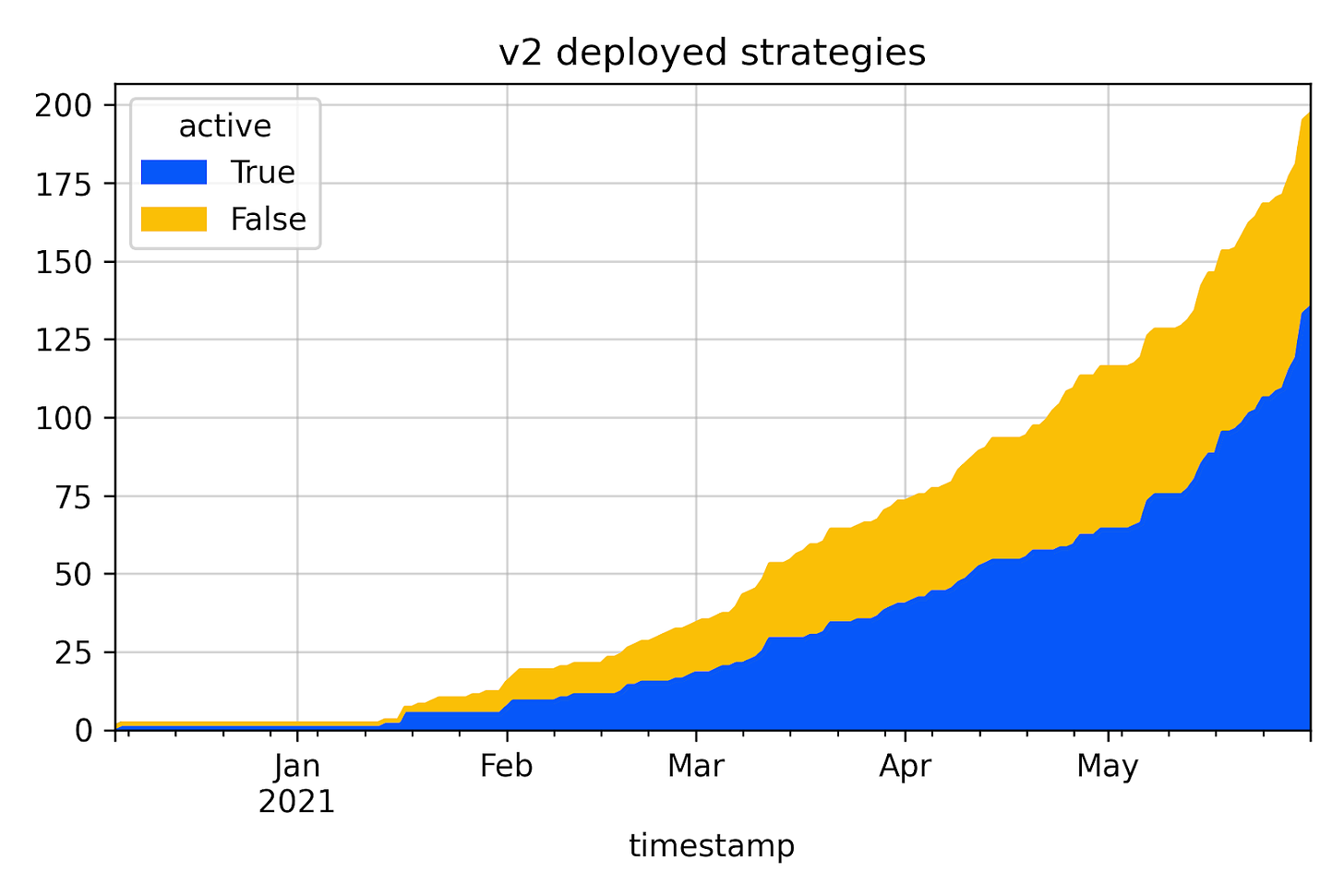

Two Hundred Yearn v2 Strategies Deployed

Yearn Strategists have built and deployed over 200 unique strategies for v2 vaults since inception. Our Strategists are among the sharpest and most hard-working members of the DeFi community. These experts work constantly to find you the best risk-adjusted returns in the market. Deposit capital to our yVaults and let the Strategists do all the hard work for you.

Several Yearn strategies can be viewed here.

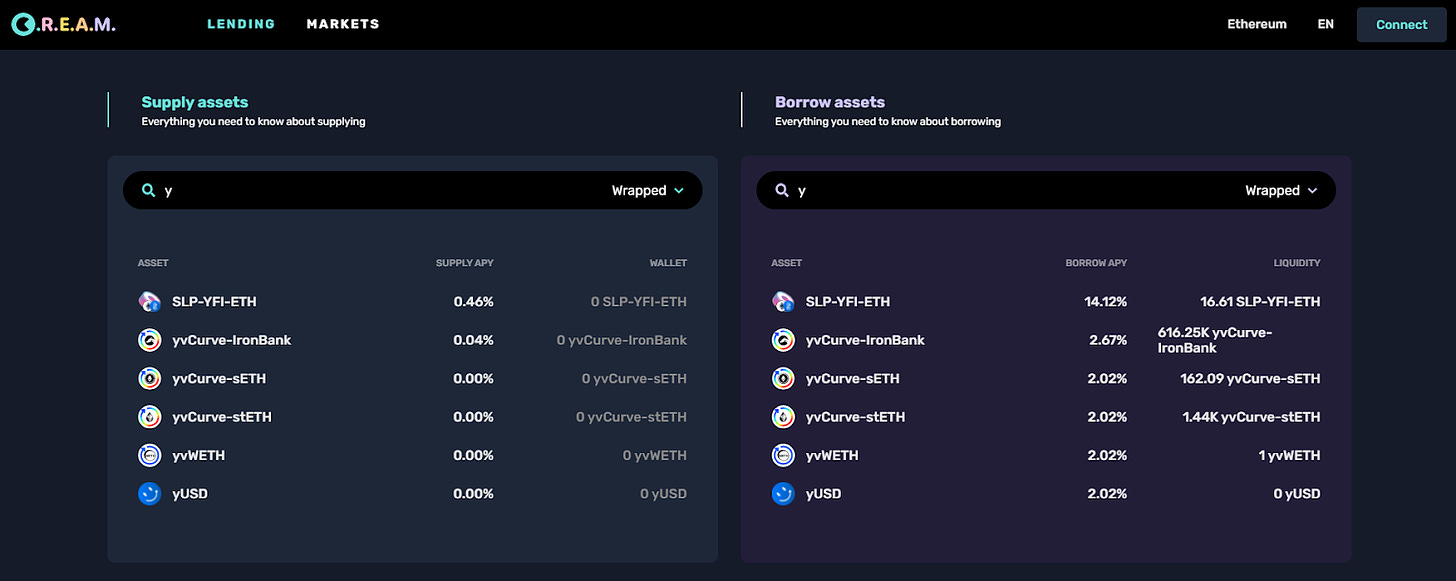

C.R.E.A.M. Finance Lists Two yVault Tokens

Two v2 yVault tokens, yUSD and yvWETH, are now listed on Yearn ecosystem partner, C.R.EA.M Finance. These vault tokens can now be supplied as collateral to borrow assets from the lending platform.

Various financial statistics can be found here.

MakerDAO’s Lower Stability Fees Benefit Yearn Strategies

MakerDAO has lowered the YFI-A stability fee to 4% and the ETH-C stability fee to 1%. These are incredibly beneficial for Yearn’s YFI and ETH strategies as they lower the cost of borrowing. The reduced cost of capital generates more net yield for users, improving returns.

More about the changes can be read here and the vaults can be found here.

Vaults At Yearn

You can read a detailed description of the strategies for all of our active yVaults here.