Yearn Finance Newsletter #38

Welcome to the 38th edition of the Yearn Finance Newsletter. Our aim with this newsletter is to keep the Yearn and the wider crypto community informed of the latest news, including product launches, governance changes, and ecosystem updates. If you’re interested in learning more about Yearn Finance, follow our official Twitter and Medium accounts.

Summary

Yearn Has Purchased And Locked 1.41M CRV For The Backscratcher

ETH Vault Gets An Upgrade

Introducing yTeam Signers

Cumulative Protocol Revenue Exceeds $27M

Yearn Is For The Little Guy

Vaults at Yearn

Yearn Has Purchased And Locked 1.41M CRV For The Backscratcher

Yearn has purchased and locked an additional 1.41 million CRV. This CRV has been locked in our “Backscratcher” vault (yveCRV) that will boost the APY of yveCRV, yvBOOST, and all vaults with Curve Finance strategies. CRV was purchased for our users using proceeds from our EPS airdrop.

Access the vaults here and here.

ETH Vault Gets An Upgrade

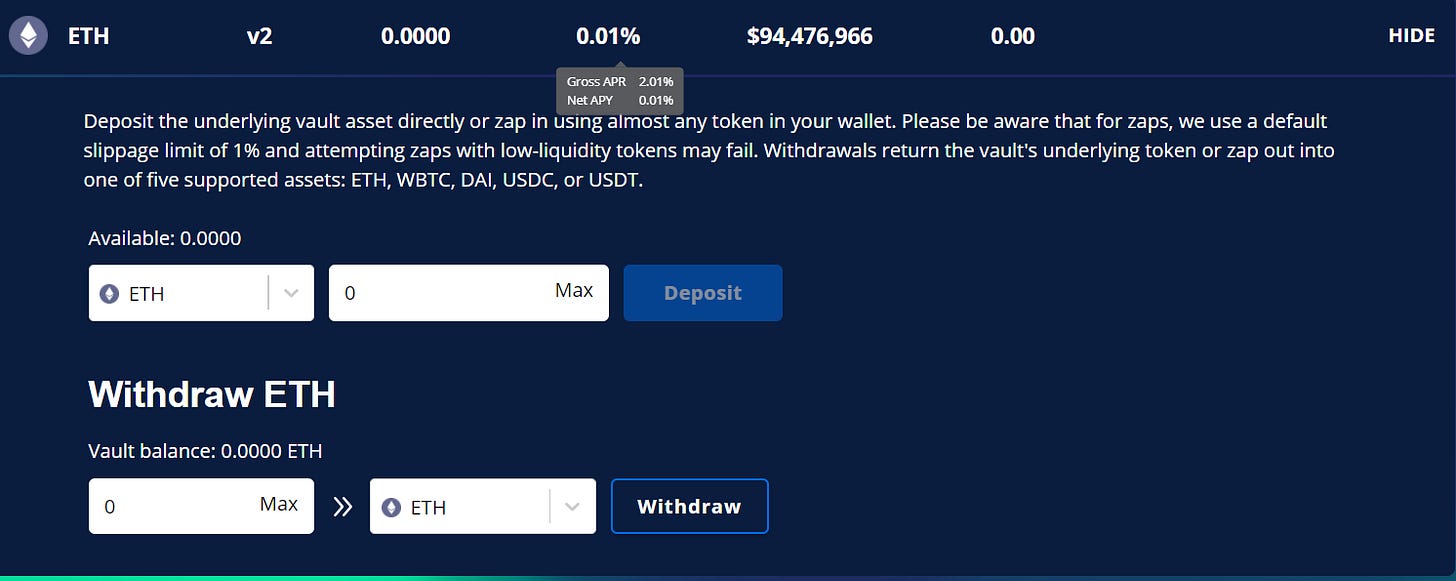

We are proud to announce updates to our v2 ETH yVault. These updates include, the latest version of Vyper, more robust security, MEV protection, and other improvements. The ETH and WETH vaults have also been merged to make the Yearn experience much simpler.

Initially, four strategies have been deployed to provide you with the best risk-adjusted yield in DeFi. These strategies are (1) a single-side deposit to the Curve StETH pool, (2) Curve sETH pool, (3) lending on AAVE, and (4) lending on Alpha Homora. Further strategies are being developed and will be implemented in the future. Let our Strategists do the hard work so you don’t have to.

The ETH vault can be accessed here.

Introducing yTeam Signers

In accordance with YIP-61: Governance 2.0, we have selected a signers for various yTeams that are used to run Yearn operations and make key decisions for the benefit of the protocol. The yTeams are designed to improve decision making speed and efficiency. Listed in the table above are the approved signers for each respective yTeam.

You can view the forum post here.

Cumulative Protocol Revenue Exceeds $27M

Yearn has earned over $27m in protocol revenue since launch, excluding the interest earned by our depositors. Revenue growth continues to trend upwards. In the past 30 days alone, the Yearn protocol has earned approximately $6m in revenue, which is approximately $75m annualized. Following the close of Q2 we will publish a comprehensive financial report for the quarter. But in the meantime, you can view a preliminary view of our financials with the dashboard here.

Yearn Is For The Little Guy

Yearn has over 20k active positions and billions of assets under management. The majority of our depositors are users depositing between $5,000 and $20,000, illustrating that Yearn is largely comprised of smaller depositors. Smaller users benefit from Yearn products as we socialize gas costs, making it more economical for smaller users to earn yield. Our largest partner by TVL is also comprised of thousands of smaller users. Our aim is to continue to provide useful services for smaller addresses to earn them yield in economical ways and to make DeFi simple.

Link to the Dune dashboard displayed above. Dune Analytics dashboard.

Vaults At Yearn

You can read a detailed description of the strategies for all of our active yVaults here.