Yearn Finance Newsletter #39

Welcome to the 39th edition of the Yearn Finance Newsletter. Our aim with this newsletter is to keep the Yearn and the wider crypto community informed of the latest news, including product launches, governance changes, and ecosystem updates. If you’re interested in learning more about Yearn Finance, follow our official Twitter and Medium accounts.

Summary

New crvTricrypto yVault Released

WOOFY Receives A Makeover

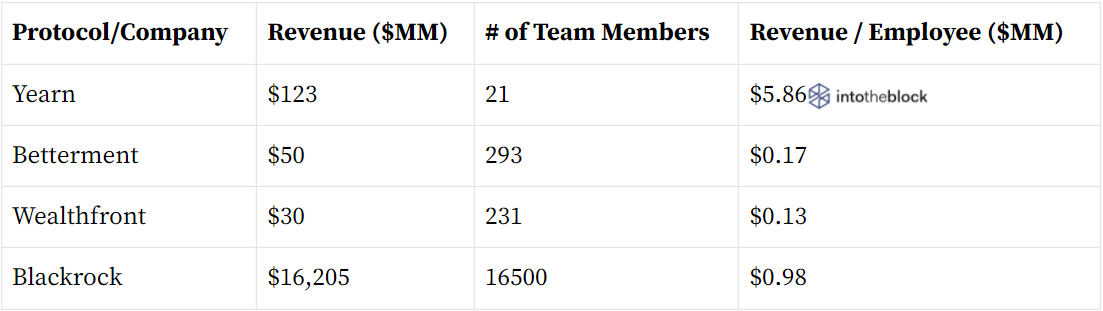

Yearn’s Revenue Per Employee Vs. TradFi

PowerPool’s YLA Gets An Upgrade

Yearn x Immunefi

Blockchain.com Wallet Releases Support For YFI

Vaults at Yearn

New crvTricrypto yVault Released

We have released a new yVault: crvTricrypto. This vault earns yield from Curve’s new WBTC, ETH, and USDT pool utilizing their v2 technology. Please note this new pool on Curve is more experimental than their other pools, and depositors are subject to Impermanent Loss. You can read more about their v2 technology and the crvTricrypto pool here.

Yearn's standard vault fees apply: 2% management fee + 20% performance fee. There are no withdrawal fees.

The vault can be found here.

WOOFY Receives A Makeover

In collaboration with Project Galaxy, we have given WOOFY a makeover, with holders and LPs across several chains eligible to receive one of six unique WOOFY NFTs. In case you missed it, WOOFY is a secondary token to YFI born out of the dog token popularity, with it being able to be converted to YFI at a 1,000,000:1 ratio.

Thanks to Teeeggs for designing the wonderful NFTs, Project Galaxy for their NFT framework, and our users for the wonderful response to the WOOFY launch.

Claim your NFT here.

Yearn’s Revenue Per Employee Vs. Traditional Finance

At Yearn, we aim to be the most efficient asset manager in not only DeFi, but the entire world. This is seen in our revenue per employee being magnitudes higher than our TradFi competitors, with a growth rate much more exponential than anyone else. Yearn continues to expand on our mission to make DeFi simple, while also being incredibly efficient. Our stats above speak for themselves. Detailed financial information will be shared in our upcoming Q2 financial report.

Further data can be found here and here.

PowerPool’s YLA Gets An Upgrade

YLA is the Yearn Lazy Ape index created by PowerPool. It is a Balancer pool composed of certain yVault LP tokens focus on Curve Finance strategies. In order to save user’s time and money from manually rebalancing and spending gas fees, it now automatically rebalances between vaults for the best yield.

In the future, the YLA’s yield maximization strategy will add prospective vaults and include the top 5 in the YLA composition, for example. They will also migrate to Balancer v2 in the future.

Supply liquidity to YLA here.

Yearn x Immunefi

Yearn has joined Immunefi to expand the reach of our Bug Bounty program. Security researchers are eligible to receive bounties for valid bugs found according to the rules of our Bug Bounty program published on Immunefi. Researchers can receive up to $200,000 per critical bug found. You can read the details of this program, including items in-scope here.

We have already awarded $200,000 to a security researcher who disclosed a valid bug. This bug was remediated immediately by members of our security team and no user funds were lost.

Blockchain.com Releases Support For YFI Interest Accounts

Blockchain.com now natively supports earning interest on YFI in their native wallet. Rates can be as high as 13.5% but may vary. You can participate by opening a Blockchain.com account, verifying your identity, and transferring funds into an Interest Account.

You can read more about this announcement here.

Vaults At Yearn

You can read a detailed description of the strategies for all of our active yVaults here.

Ecosystem News

Tracheopteryx reveals more about Coordinape, a new governance tool built for Yearn and other DAOs

joinwido.com is working on historical data visualization for yVaults APYs by using the Yearn SDK

C.R.E.A.M. Finance utilizes Coordinape built for the Yearn ecosystem for their own DAO procedures