Welcome to the 46th edition of the Yearn Finance Newsletter. Our aim with this newsletter is to keep the Yearn and the wider crypto community informed of the latest news, including product launches, governance changes, and ecosystem updates. If you’re interested in learning more about Yearn Finance, follow our official Twitter and Medium accounts.

Summary

Behind the Scenes at Yearn

Primer on the yvBOOSTVault

Yearn Quarterly Financial Report

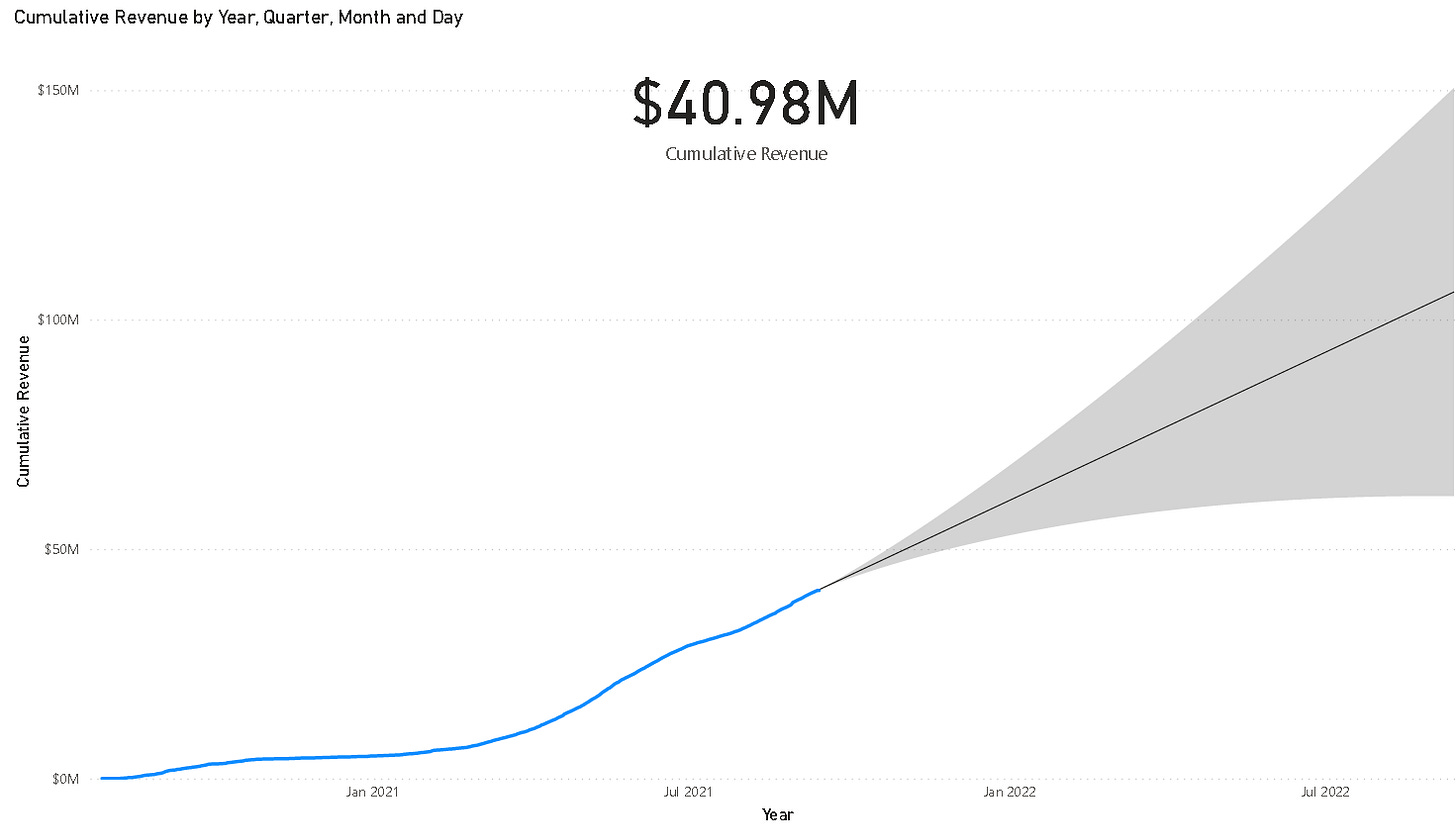

Cumulative Protocol Revenue Reaches $41M

Vaults at Yearn

Ecosystem News

Behind the Scenes at Yearn

As you may know, Yearn is the yield function protocol for DeFi, with many strategists coding ways to get optimal returns for our users using flexible smart contracts that allocate efficiently to various protocols. Because Yearn needs to keep up with the competitive yield aggregation market, we need to deploy strategies quickly, and this means there are always security risks.

There are 176 strategies for 64 vaults total as of today, and to work through security risks, we need to have a solid risk framework. To mitigate security risks, we have added options such as simulation bots to catch issues or on chain healthchecks. One can read more about Yearn’s emergency procedures here.

You can also view details about vaults and strategies on yearn.watch.

Check out more information on Yearn’s security procedures at storming0x’s tweet here.

Primer on the yvBOOST Vault

CRV is curve.fi’s governance token, which can be locked for up to 4 years and gives you the ability to vote and claim protocol fees. By using Yearn to lock your CRV for veCRV (vote-escrowed CRV), you can earn more rewards via Yearn periodically donating some of our farmed CRV to the yveCRV vault. So, in addition to normal CRV rewards, you will be able to claim Yearn’s portion of Curve’s protocol fees.

However, with veCRV deposited in Yearn (as yveCRV), you can’t vote on Curve. Even with this minor setback, Yearn runs a simulation and votes to maximize yield across all vaults.

One of our newer additions to Yearn is the yvBOOST vault, which is a compounding version of yveCRV. If you lock CRV here, it will claim the protocol rewards and automatically buy more yveCRV, thus compounding it. You can’t vote with yvBOOST still, but the vault will automatically do it for you. Deposit and enjoy your rewards.

If one needs stables from their deposits from the vaults, you can swap yveCRV and yvBOOST on SushiSwap.

If you don’t have any CRV, thanks to Yearn Zaps, you can deposit virtually any crypto in your wallet into these vaults. And Yearn’s smart contracts will automatically convert your tokens to yvBOOST.

As always, thank you to our Strategists for always building top tier yield infrastructure for DeFi.

Check out the vaults here at yearn.finance/vaults.

Yearn Quarterly Financial Report

Several Yearn community members have created an informal quarterly financial report covering the period from April 2021 to June 2021. This report was generated using publicly available information, and includes an income statement and balance sheet. This report has not been audited by a third-party professional accounting firm, and does not represent financial, investment, or advice of any kind. It is for informational purposes only.

You can view this report here.

Cumulative Protocol Revenue Reaches $41M

Yearn has earned nearly $41 million in revenue, since launch (excluding the interest earned by depositors). In the past 30 days, nearly $6 million dollars in revenue has been generated by the protocol. An extrapolation of this data projects annual revenue to be nearly $60 million.

Yearn’s cumulative revenue and other statistics are viewable here.

Vaults At Yearn

You can read a detailed description of the strategies for all of our active yVaults here.

Ecosystem News

Sign up to become an intern at the yAcademy DAO and audit live smart contracts

YFI/ETH SushiSwap liquidity tokens are available as collateral on OnX’s Alpha Vaults

rKP3R rewards added for Fixed Forex

Thank you to abracadabra.money for bringing 173.4M dollars of TVL to Yearn

HI

let's go up together