Welcome to the 47th edition of the Yearn Finance Newsletter. Our aim with this newsletter is to keep the Yearn and the wider crypto community informed of the latest news, including product launches, governance changes, and ecosystem updates. If you’re interested in learning more about Yearn Finance, follow our official Twitter and Medium accounts.

Summary

Introducing V3 of Yearn’s UI

Check Out the New Labs Section

Yearn Has Purchased $320K of YFI in September

Cumulative Protocol Revenue Reaches $43M

Vaults at Yearn

Ecosystem News

Introducing V3 of Yearn’s UI

This week, we have opened up the new Yearn v3 to users in beta. The new friendlier interface surfaces all the data you need for a birds-eye view of your holdings and historical plus yearly earnings. It also simulates transactions so you don't get unexpected slippage or failed transactions.

Rebuilt from the ground up, v3 is the realization of a shared vision of a lightweight, scalable system ready for the multichain future. The core components of the Yearn V3 stack have been divided up into multiple distinct components: Lens, Meta, Subgraph, Exporter, SDK, and Front-end.

As for the UI, we have revamped the Yearn experience for mobile users and added new sections such as the Home, Wallet, Labs, Iron Bank, and Settings pages. Additionally, there will be multiple UI themes, with some being unlockable for specific NFT holders. See galaxy.eco/yearn for potential NFTs that qualify for future themes.

Thank you to the Yearn community and all the contributors at Yearn who helped to make this happen. If you’d like to contribute, come join our public discord, create an issue in one of the repos linked in the medium, or share your designs with us on twitter!

Read an in-depth rundown on the V3 UI here.

Check out beta.yearn.finance.

Check Out the New Labs Section

Introducing the Labs section on the new Yearn V3 UI, a set of experimental vaults that push the boundaries of yield in DeFi. Let’s take a look at these new vaults.

The vaults that live in the LABS section are not the usual Yearn vaults. Yearn vaults were created with the idea of being long only and that users could withdraw at any time. You asked for different types of vaults and strategies on various platforms and our recent product survey. We listened!

In labs, experimentation is the norm, not the exception. Read what each vault does, and read carefully. Strategies may allow lock-ups and the potential for temporary losses in pursuit of increased, long-term sustainable yield.

You may already know yveCRV, yvBOOST, and our yvBOOST-ETH pJar (a collab with Pickle Finance), which are now live in Labs. We will shortly be adding more vaults to Labs, with detailed pages for each.

So, check out Labs at beta.yearn.finance/#labs and come back for more emerging strategies. Just remember, these vaults are usually riskier than others, as they can involve token locking, impermanent loss, and various other risks.

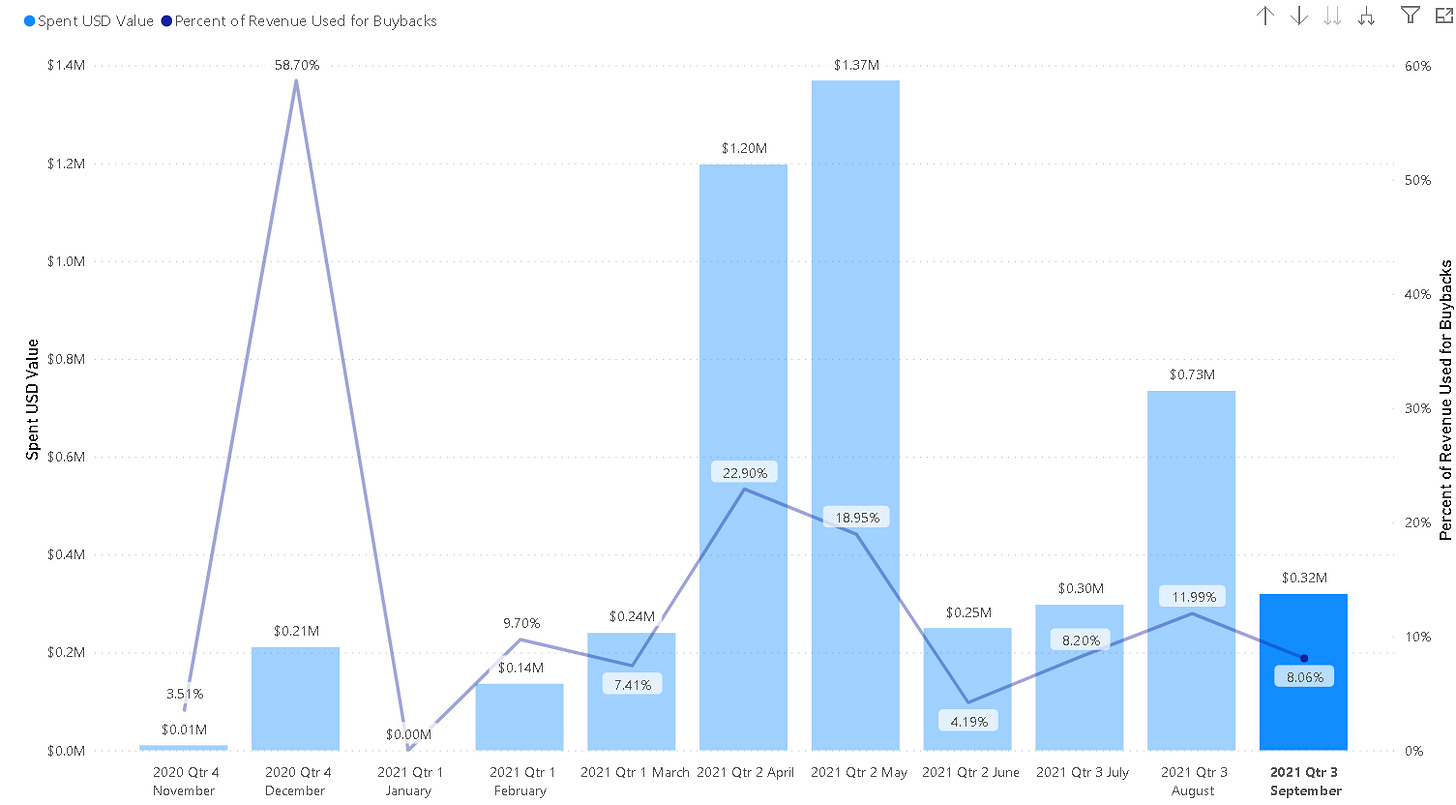

Yearn Has Purchased $320K of YFI in September

In accordance with YIP-56: Buyback and Build Yearn, which was passed in January 2021, the Yearn Treasury has purchased an additional $320K worth of YFI.

Yearn Treasury will periodically purchase additional YFI in the future using profits earned by the protocol until a new governance proposal is passed that alters this buyback policy. You can read about the BABY proposal here.

Data on the buybacks can be found here.

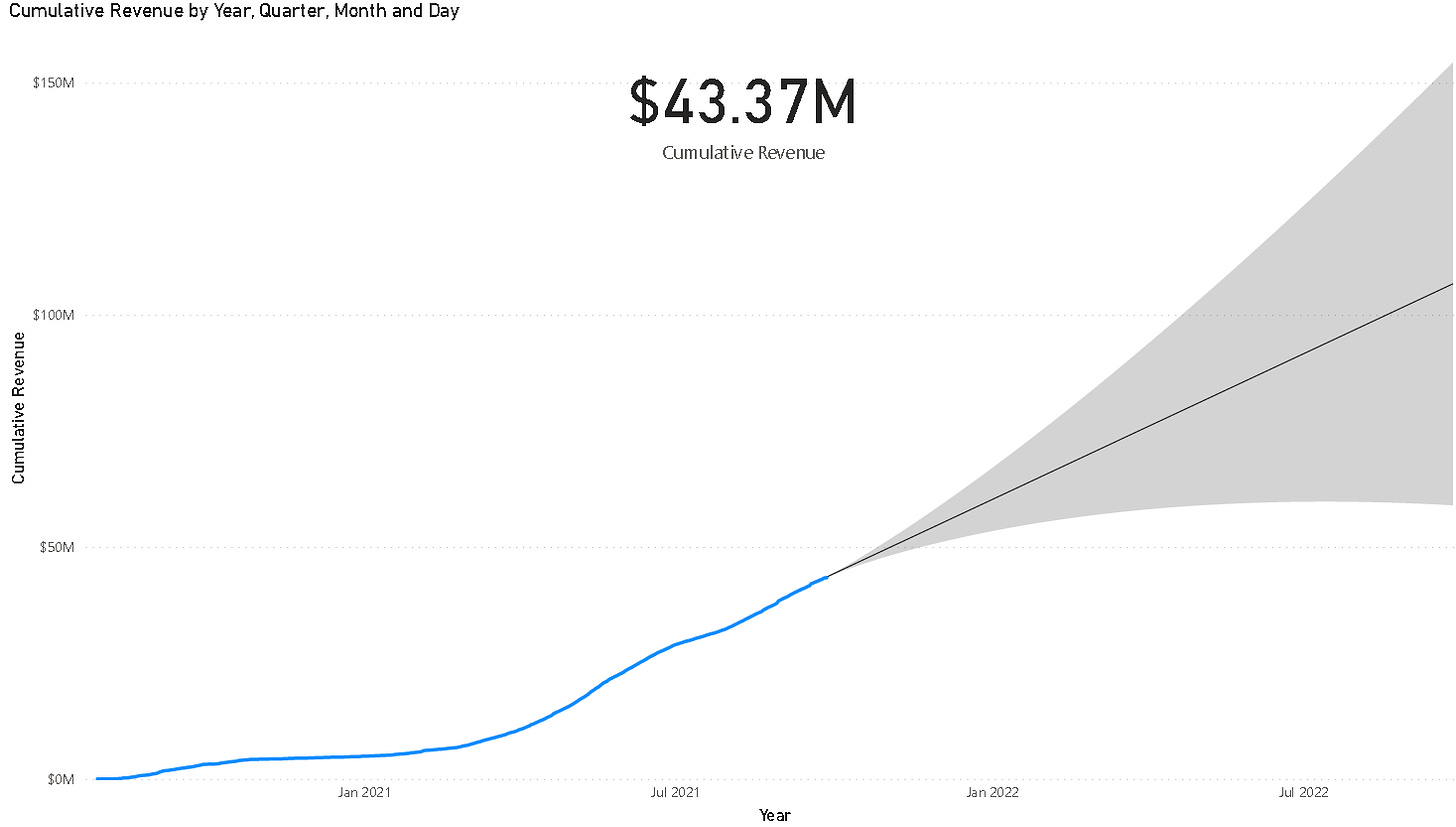

Cumulative Protocol Revenue Reaches $43M

Yearn has earned nearly $43 million in revenue, since launch (excluding the interest earned by depositors). In the past 30 days, nearly $6 million dollars in revenue has been generated by the protocol. An extrapolation of this data projects annual revenue to be nearly $70 million.

Yearn’s cumulative revenue and other statistics are viewable here.

Vaults At Yearn

You can read a detailed description of the strategies for all of our active yVaults here.

Ecosystem News

Check out Metaguild using the Coordinape framework

Tracheopteryx and 0xMaki speak about DAO design at the Messari Mainnet event

Steakwallet supports Yearn vaults in-app

Donut is building a retail-friendly savings app on top of Yearn

Yearn bounties have launched on Flipside Crypto

Use yvFTM as collateral on abracadraba.money on Fantom

Check out the Yearn Fundamentals Dashboard on Token Terminal

很不错啊

nice